-

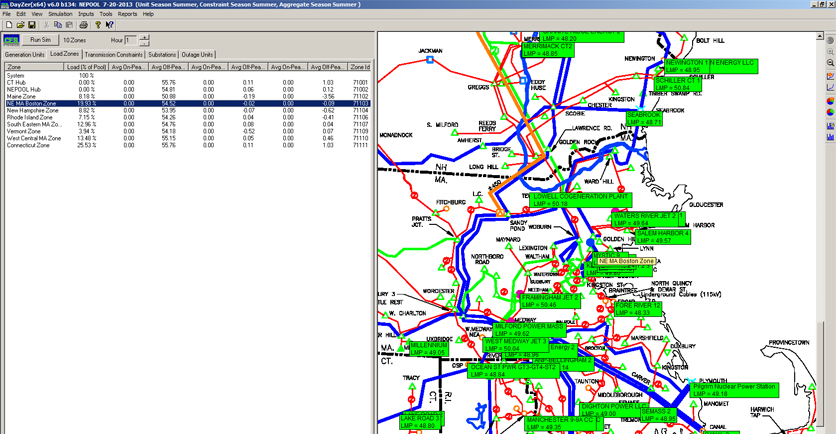

DAYZER

Day Ahead Market analyzer available for the CAISO, ERCOT, MISO, NEPOOL, NYISO, ONTARIO, PJM, SPP and WECC markets

-

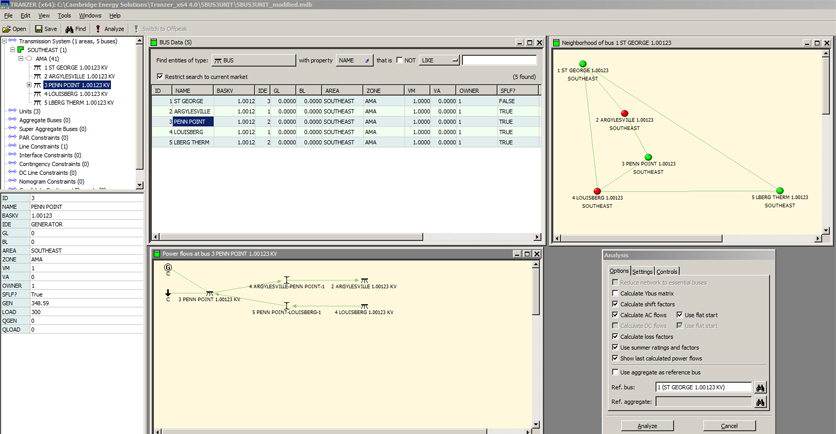

TRANZER

Transmission Analyzer

-

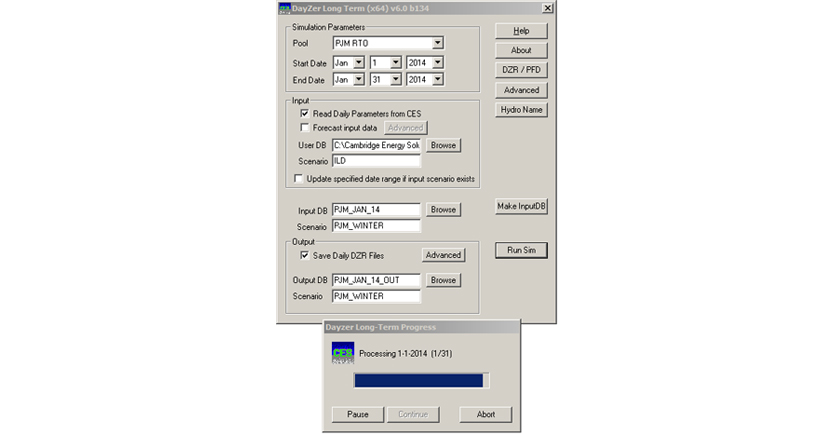

DAYZER Long

A convenient GUI tool for running DAYZER simulations

-

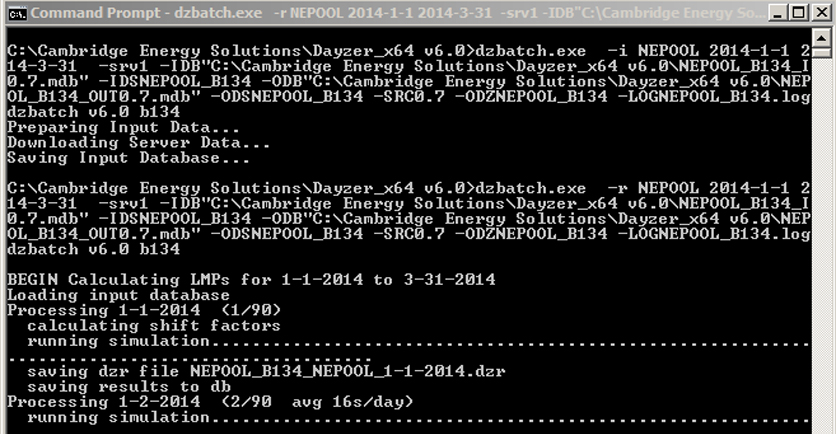

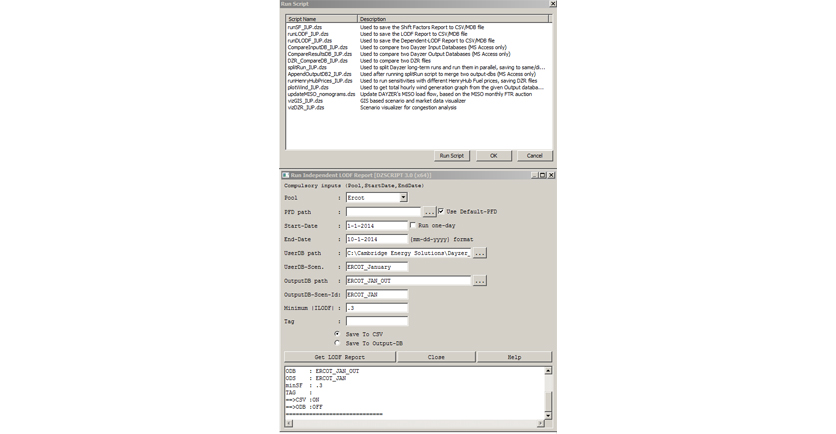

DZBatch

A command line tool for running DAYZER simulations

-

DZScript

A DAYZER-specific scripting language

-

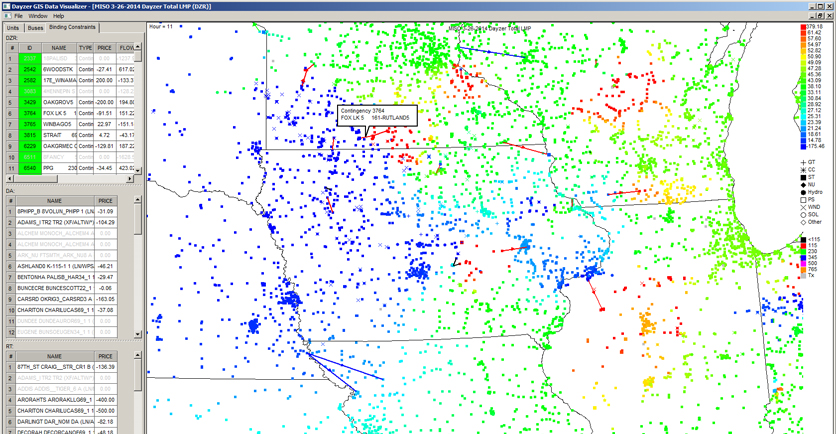

Dayzer Visualizer

A geospatial tool for viewing the results of DAYZER simulations on a map.

-

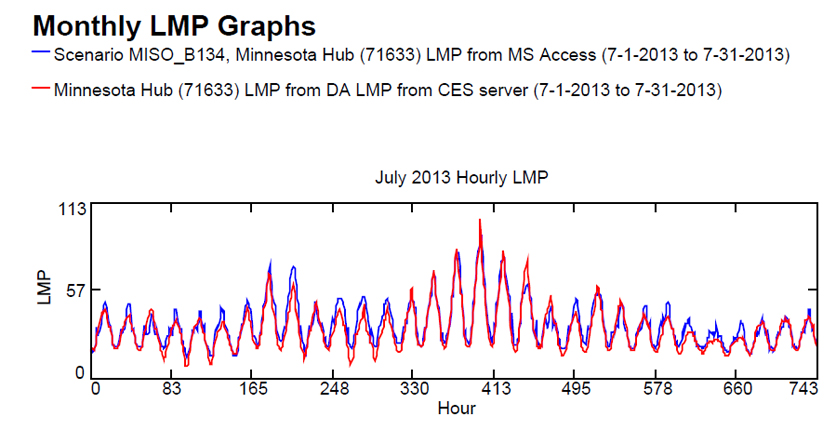

DZ Reporter

A charting tool for reporting DayZer input assumptions and simulation results

-

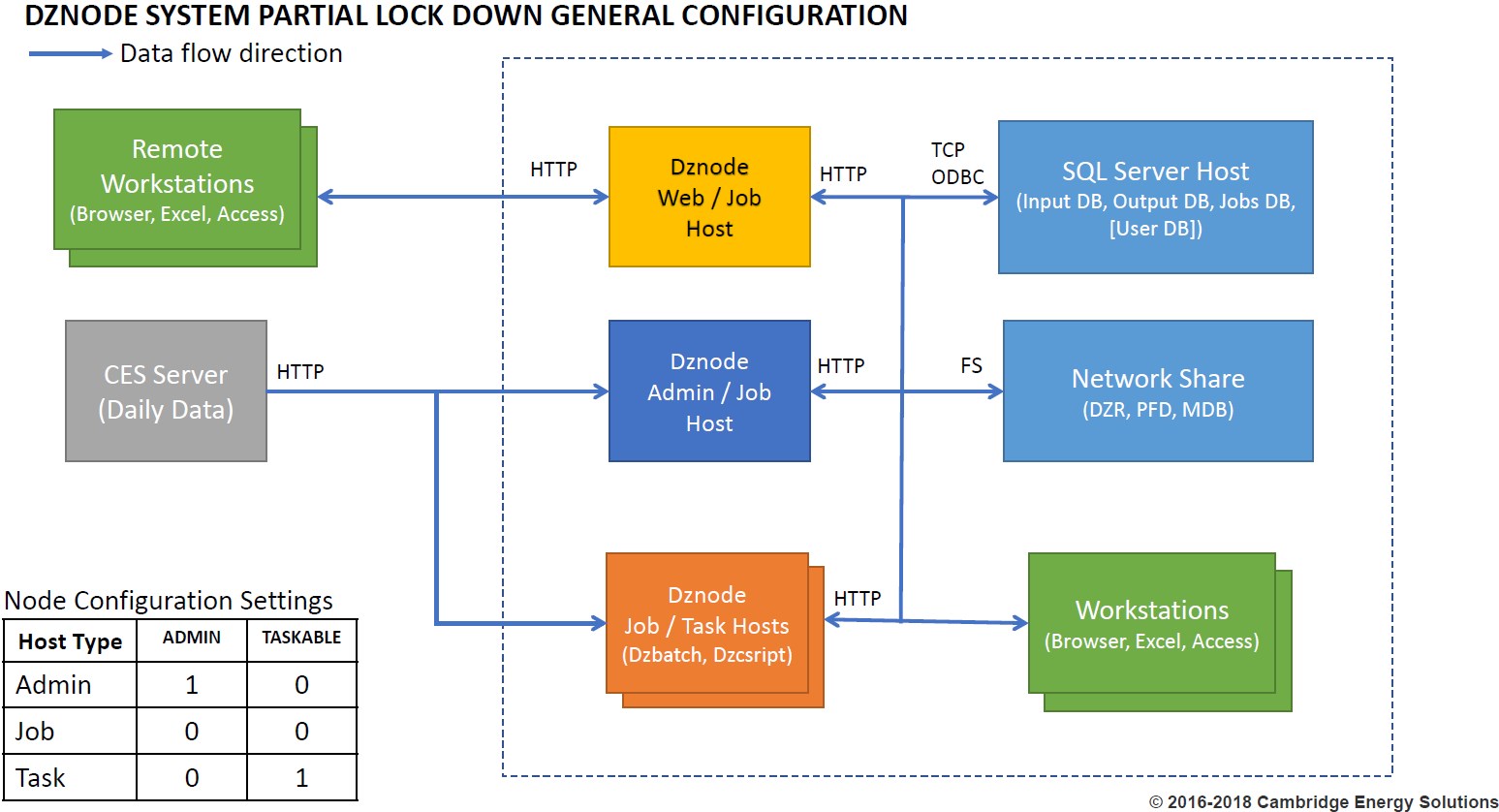

DZNODE

Dayzer Web Interface and Distributed Run Manager (dznode) A powerful simulation management tool

-

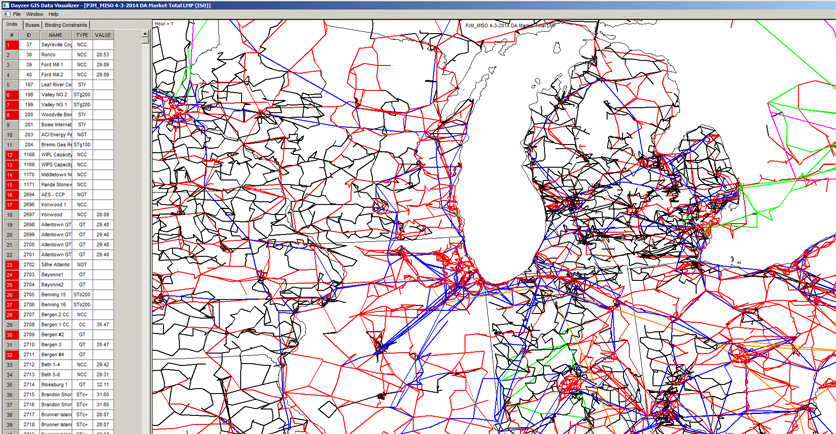

PJM MISO Grid

Dayzer Visualizer snapshot of transmission system

-

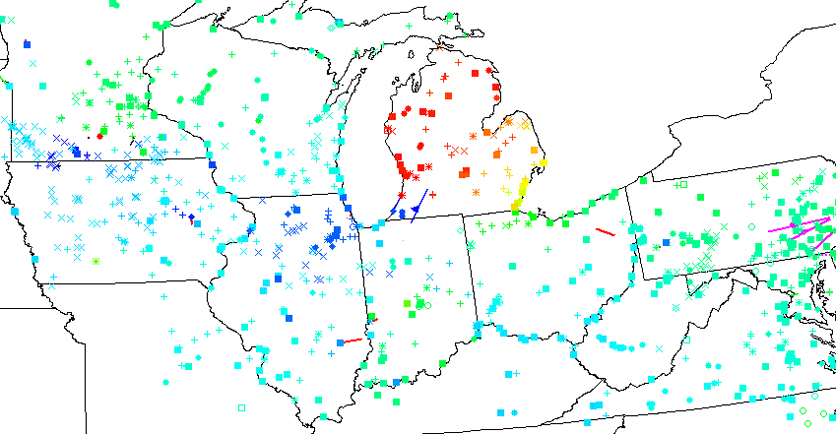

PJM MISO Units

Dayzer Visualizer snapshot of On line Units

Welcome to Cambridge Energy Solutions (CES-US)

Cambridge Energy Solutions (CES-US) is a software company with a mission to develop software tools for participants in deregulated electric power markets. CES-US provides information and tools to assist market participants in analyzing the electricity markets on a locational basis, forecast and value transmission congestion, and to understand the fundamental drivers of short- and long-term prices.

PowerGem/CES 2025 User Group Meeting - October 28-30, 2025. Renaissance Phoenix Downtown Hotel, Phoenix, AZ.

Users need to register for the conference. Register for PowerGem/CES 2025 User Group Meeting

Testimony from a DAYZER user:

"Dayzer is an efficient production cost model in analyzing the properties of the market system and processes used in clearing and pricing various energy markets. Its distinction is the flexibility it brings to the functional and technical requirements of the base implementation of a transmission topology consistent with the ISO's unified formulations, market algorithms and planning assumptions."

"I have utilized Dayzer in various forms (fundamental analysis of congestion, generation and transmission expansion and reliability planning, etc..) however my best experience with the tool is the implementation of Nuclear Asset Rationalization in the energy market, while working for a large utility participating in the PJM market. Dayzer's flexibility (is second to none) in incorporating ISO's market assumptions to calculate the price impact of cycling nuclear units for congestion that leads to significant negative prices at the unit bus. The result of this project led to major changes in the ISO market methodology around nuclear assets. The initial project saved more than $80 Million, and since then saved the market more in congestion cost, reduced FTR underfunding and helped avoid early nuke retirement."

"I have used several production cost models in the last decade and I can say Dayzer offers the best prototype environment to simulate the ISO energy market operations."

Fredrick IkugbagbePower Trader

Testimony from a second DAYZER user:

"When NYISO announced the additional of >100kV Secured Lines in their Market we quickly modeled the new lines in Tranzer and ran Dayzer simulations that accurately picked up the binding element out of the numerous possibilities."

"That information allowed us to get ahead of the market, accurately bid into the TCC auctions, and realize over $5M of profit."

FTR trader in the Northeast

Future of Energy in Focus:U.S. Power Markets Opportunities and Challenges

Economic recovery from a global pandemic, the path towards clean energy, and navigating implications of climate change are only a few examples of the challenges the nation is facing as we enter a new administration.

Join S&P Global Platts and Assef Zobian, Founder and President at Cambridge Energy Solutions, for an insightful discussion examining the opportunities and challenges ahead for U.S. power markets.

Click on this link and press Replay

Cambridge Energy Solutions is recognized in the list of top ten companies in the US providing services to electric power utilities.

"In this edition, we have listed the top 10 transmission and distribution consulting/services companies to highlight those making significant contributions to the utilities sector. Equipped with innovative technological capabilities, these transmission and distribution consulting/services companies are set to transform the landscape."