DAYZER

Day-Ahead Locational Market Clearing Prices Analyzer (DAYZER). Cambridge Energy Solutions has developed DAYZER to assist electric power market participants in analyzing the locational market clearing prices and the associated transmission congestion costs in competitive electricity markets. Using DAYZER algorithms as a core, CES has published models for each of the competitive electric markets in North America and some larger regions such as the WECC. This tool simulates the operation of the electricity markets by mimicking the dispatch procedures used by the corresponding independent system operators (ISOs), and replicates the calculations made by the ISOs in solving for the security-constrained, least-cost unit commitment and dispatch in the Day-Ahead markets.

DAYZER forecasts hourly locational market-clearing prices and congestion costs, using the most recently available assumptions on generator economics, fuel prices, demand forecast, unit and transmission line outages, and emission permits costs, which are fully integrated into the DAYZER model and updated on CES servers on a monthly, daily, or hourly basis. Any of these assumptions can be easily overwritten by the user. DAYZER incorporates all the security, reliability, economic and engineering constraints on generation units and transmission system components. It can be easily modified to emulate the specific operation of any regional market and the dispatch or operating procedures adopted and used by various ISOs. It is tailor-made for each regional market to capture the particularities of that market. DAYZER is currently available for the CAISO, ERCOT, MISO, NEPOOL, NYISO, ONTARIO, PJM, SPP and WECC markets, and we also published a combined model for the PJM-MISO, SPP-MISO, PJM-NYPP and NYPP-NEPOOL regions. DAYZER has the following features:

- Easy to use

- Accurate security-constrained unit commitment and dispatch algorithms that mimics those used by the ISOs in the Day-Ahead market

- Accurate and up-to-data inputs and assumptions Uses NAPD for information on generation and transmission system elements (see database description below)

- Accurate modeling of each market with its own particularities (second contingency constraints, losses methodology, locational reserve markets, etc..)

- Captures marginal transmission losses in dispatch and clearing prices in markets where implemented

- Graphical user interface plus Access database output, plus many reports that make the model transparent and flexible.

- Captures transmission outages, transmission contingencies, nomograms, as well as planned transmission upgrades

- Accurate modeling of phase angle regulators, loop flows and Imports/Exports from neighboring regions or DC ties.

- Allows users to analyze various scenarios and quantify the impact of key market drivers

- Tested against actual market prices with excellent results (see DAYZER brochure)

- In addition to DAYZER as a core, DAYZER long-term uses the following modules:

- Long–term load forecast (based on historical load shape and forecasted peak demand)

- Fuel prices from NYMEX (Fuel Oil and Natural Gas)

- Random Outage using Bernoulli probability model

- Maintenance schedule (optimized based on reserves)

Brochure-V5.1-B125

Brochure-V4.0-B121

Brochure-V3.5-B101

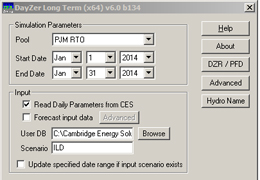

DAYZER Long

Dayzer Long-Term is a convenient GUI tool for running DAYZER simulations for many days at one time and saving the results to an Access, SQL, or Oracle database.

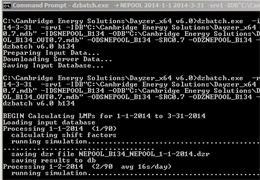

DZBatch

DZBatch is a command line tool for running DAYZER simulations with various run-options enabled. It uses the same algorithms as DAYZER and DayzerLong, and is well suited for systematic analyses that can be scheduled and executed automatically

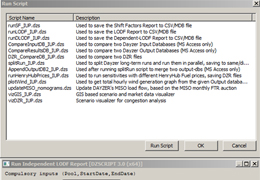

DZScript

DZscipt is a DAYZER-specific scripting language that allows full observation and customization of DAYZER’s inputs, output, and assumptions.

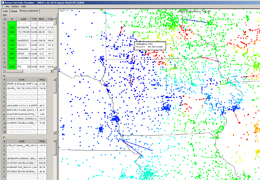

Dayzer Visualizer

Dayzer Visualizer is a geospatial tool for viewing the results of DAYZER simulations on a map. Layers include unit and nodal LMPs, constrained paths, the full transmission system, and local geography

DZreporter

DZreporter is a charting tool for reporting time series assumptions and results from DAYZER scenarios in .pdf format.

DZNODE

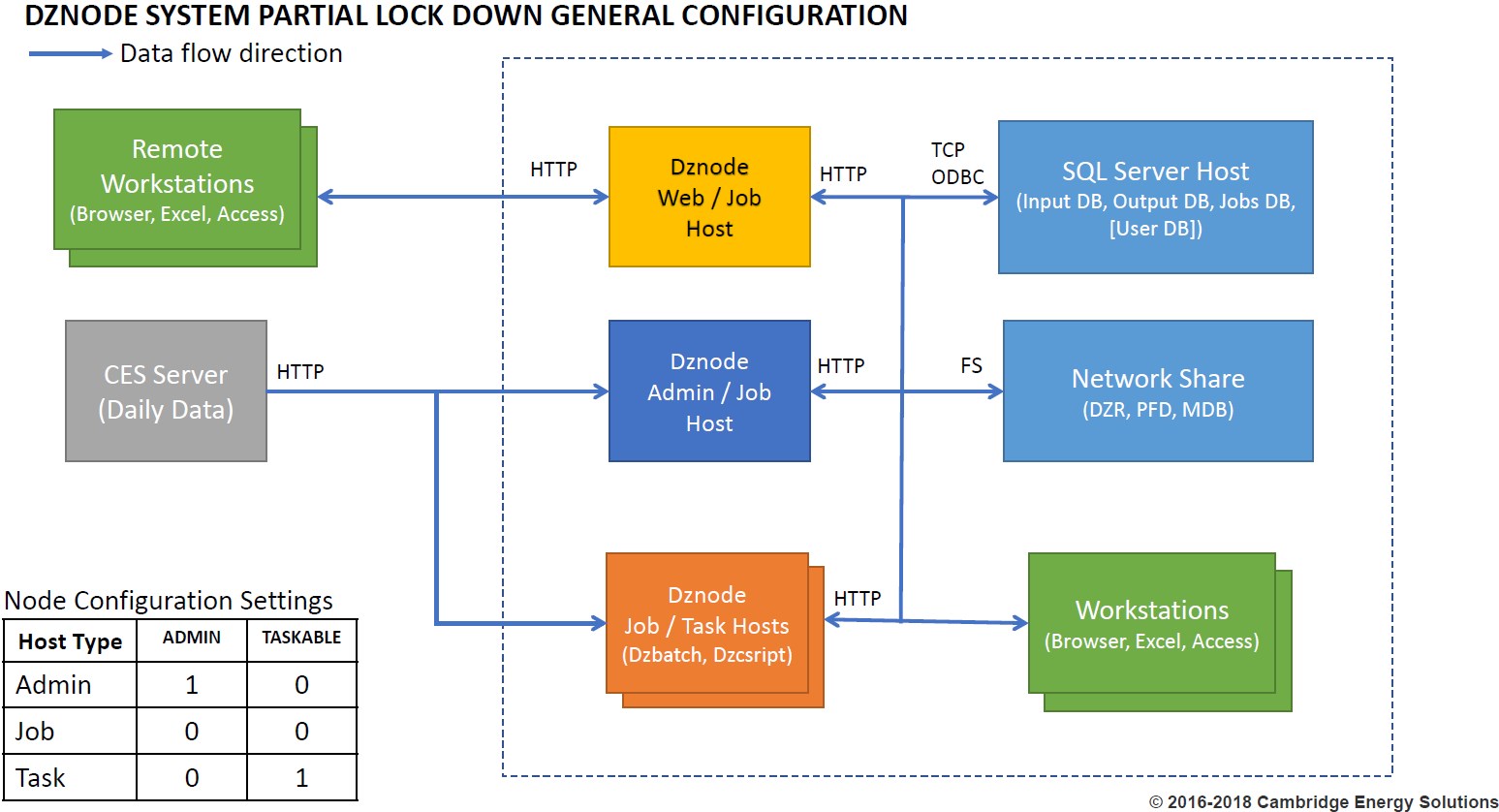

Dznode application can be used to manage Dayzer simulation runs on multiple computing nodes. It also provides a web based graphical user interface to the inputs and outputs of these simulations. Using dznode a multi-day Dayzer simulation can be split into many intervals and assigned to independent task processes that will run each interval in parallel on one or more host machines. Each dznode instance is installed as a Windows Service on a host machine and communicates with other dznode instances using HTTP over a user specified port. A Dayzer jobs database that allows dznode instances to discover each other and to maintain common state is also required and must be hosted on a SQL Server instance accessible from all host machines. Each dznode host machine must have Dayzer installed with the ODBC settings in the dayzer.ini file configured so that the input and output databases are hosted on the same SQL Server instance that hosts the Dayzer jobs database. User scenarios can be stored in the SQL Server input database or specified using MS Access files.